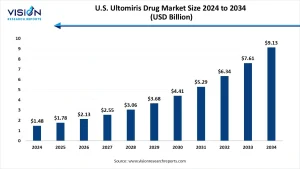

The U.S. ultomiris drug market size was exhibited at around USD 1.48 billion in 2024 and it is projected to hit around USD 9.13 billion by 2034, growing at a CAGR of 19.95% from 2025 to 2034.

Get a Sample@https://www.visionresearchreports.com/report/sample/41720

U.S. Ultomiris Drug Market Overview

Ultomiris (ravulizumab) is a next-generation complement inhibitor that has emerged as a breakthrough treatment for rare blood disorders such as paroxysmal nocturnal hemoglobinuria (PNH) and atypical hemolytic uremic syndrome (aHUS). As a long-acting C5 inhibitor, Ultomiris offers extended dosing intervals, improving patient compliance and reducing treatment burden. With its clinical superiority and growing approval for multiple indications, Ultomiris is witnessing significant adoption across the U.S. healthcare landscape.

U.S. Ultomiris Drug Market Growth

The growth of the Ultomiris market in the U.S. is largely fueled by its rapid uptake as a preferred therapy for PNH and aHUS. The drug’s extended dosing schedule, which requires less frequent administration compared to its predecessor Soliris, has gained widespread acceptance among both clinicians and patients. This has directly translated into increased demand and greater market penetration, especially within specialized treatment centers and tertiary care hospitals.

Moreover, the expanding clinical pipeline and regulatory approvals for new indications such as generalized myasthenia gravis (gMG) and neuromyelitis optica spectrum disorder (NMOSD) are expected to further accelerate Ultomiris adoption. As more patients become eligible for treatment, and as insurance coverage expands, the U.S. market is poised for exponential growth over the coming decade.

U.S. Ultomiris Drug Market Dynamics

Driven by

- Strong clinical efficacy and safety profile of Ultomiris

- High prevalence of rare complement-mediated disorders in the U.S.

- FDA approvals for multiple indications and age groups

Opportunities

- Expansion into new disease areas such as NMOSD and transplant-associated TMA

- Partnership and co-marketing strategies with healthcare providers

- Rising patient awareness and early diagnosis of rare disorders

Challenges

- High treatment costs may limit access among underinsured populations

- Competition from emerging biosimilars and next-gen complement inhibitors

- Dependency on infusion-based delivery limits use in remote areas.

Rising Demand for Ultomiris in the U.S. Healthcare System

The demand for Ultomiris in the U.S. has been steadily climbing due to its unmatched convenience and efficacy. Its ability to reduce the frequency of infusions administered every 8 weeks instead of every 2 weeks like Soliris has significantly improved the quality of life for patients. Additionally, healthcare providers increasingly favor Ultomiris for its reduced hospital burden and resource optimization. As clinical protocols continue to evolve, Ultomiris is expected to become a cornerstone therapy in managing complement-mediated diseases across the country.

Pricing Strategy and Cost Implications for U.S. Consumers

While Ultomiris delivers transformative benefits, its high cost remains a topic of concern. Priced at hundreds of thousands of dollars annually per patient, affordability and reimbursement become key issues. Manufacturers have implemented patient support programs and value-based pricing models to ease the financial burden, but disparities in access persist. Going forward, pressure from payers and the rise of alternative therapies may prompt pricing adjustments to enhance affordability while maintaining innovation incentives.

U.S. Ultomiris Drug Market Trends

- Increasing preference for long-acting therapies in rare disease management

- Expansion of Ultomiris into neurology and other therapeutic segments

- Shift towards value-based reimbursement strategies by U.S. insurers

- Growing investments in specialty care infrastructure and infusion centers.

Read More:https://www.heathcareinsights.com/europe-pharmaceutical-market/

Top Companies in U.S. Ultomiris Drug Market

- AstraZeneca plc (Alexion Pharmaceuticals)

- Pfizer Inc.

- Roche Holding AG

- Amgen Inc.

- Johnson & Johnson

- Novartis AG

- Biogen Inc.

- Hoffmann-La Roche Ltd. (Genentech)

- Regeneron Pharmaceuticals Inc.

- Takeda Pharmaceutical Company Limited

U.S. Ultomiris Drug Market Segments

- Indication: PNH, aHUS, gMG, NMOSD, Others

- Route of Administration: Intravenous

- End User: Hospitals, Specialty Clinics, Homecare Settings

Future Outlook

The future of the U.S. Ultomiris drug market is highly promising. With continued clinical advancements, broader indication approvals, and strategic pricing adaptations, Ultomiris is well-positioned to dominate the complement inhibitor space. As healthcare systems prioritize efficient and effective rare disease management, the drug’s market potential remains strong. By 2034, Ultomiris is expected to be a central player in the U.S. rare disease therapeutic landscape, backed by robust commercial and clinical momentum.

Buy this Premium Research Report@https://www.visionresearchreports.com/report/checkout/41720

You can place an order or ask any questions, please feel free to contact

sales@visionresearchreports.com| +1 650-460-3308