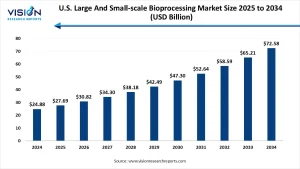

The U.S. large and small-scale bioprocessing market size was reached at USD 24.88 billion in 2024 and it is projected to hit around USD 72.58 billion by 2034, growing at a CAGR of 11.3% from 2025 to 2034.

U.S. Large and Small-scale Bioprocessing Market Overview

Bioprocessing refers to the use of living cells or their components like enzymes and bacteria to produce drugs, vaccines, and bio-based products. It plays a crucial role in the production of monoclonal antibodies, cell and gene therapies, and vaccines. In the U.S., both large-scale facilities operated by major pharmaceutical companies and smaller setups by biotech startups are contributing to the dynamic expansion of the bioprocessing landscape.

Get a Sample@ https://www.visionresearchreports.com/report/sample/41774

U.S. Large and Small-scale Bioprocessing Market Growth

The growing prevalence of chronic diseases such as cancer, autoimmune disorders, and rare genetic conditions has led to an increased need for biologic drugs. These complex therapies require sophisticated bioprocessing techniques for scalable and compliant production. As biologics continue to dominate the pharmaceutical pipeline, demand for robust bioprocessing solutions both at pilot and commercial scale is rising rapidly.

Moreover, advancements in single-use technologies and continuous bioprocessing are improving production flexibility and reducing contamination risks. This enables smaller companies to enter the market without investing in massive infrastructure, further fueling growth. Government support through tax incentives, research grants, and fast-track approvals for biologics is also accelerating innovation in the sector.

U.S. Large and Small-scale Bioprocessing Market Trends

- Shift Toward Single-use Systems: The adoption of disposable bioreactors and single-use technologies is on the rise, offering greater efficiency, reduced cross-contamination, and lower setup costs.

- Integration of AI and Automation: Smart bioprocessing platforms incorporating AI, IoT, and real-time monitoring systems are improving product consistency and process optimization.

- Rise in Contract Manufacturing: Biopharma companies are increasingly outsourcing their bioprocessing needs to CDMOs (Contract Development and Manufacturing Organizations), boosting the growth of specialized service providers.

- Focus on Modular Bioprocessing Facilities: Modular and mobile production units are becoming popular, especially for small-scale production or in response to pandemic situations that require flexible deployment.

What is Bioprocessing and Why Does it Matter?

Bioprocessing is the use of living cells or biological materials (like enzymes or microorganisms) to produce valuable products—mainly pharmaceuticals, vaccines, and biologics. Instead of using chemical reactions alone, bioprocessing relies on biological systems to carry out complex tasks in a controlled environment.

It plays a key role in modern medicine, especially in the development and manufacturing of treatments for cancer, autoimmune disorders, and infectious diseases. Without bioprocessing, we wouldn’t have essential therapies like insulin, monoclonal antibodies, or mRNA vaccines.

Why the U.S. Bioprocessing Market is Booming

The U.S. bioprocessing industry is experiencing rapid growth due to a combination of scientific innovation, strong healthcare demand, and investment support. Several key factors are fueling this boom

- Rise in Biologic Drugs: Unlike traditional small-molecule drugs, biologics are more effective for treating chronic and rare diseases driving demand for bioprocessing infrastructure.

- Pandemic Response Acceleration: COVID-19 highlighted the need for fast, scalable vaccine production, which pushed bioprocessing capacity to new heights.

- Investment and Incentives: Public and private sectors are pouring funds into biomanufacturing facilities, startups, and R&D projects.

- Personalized Medicine: As medicine becomes more patient-specific, there’s a growing need for flexible, small-batch bioprocessing technologies.

Large vs. Small-Scale Bioprocessing: What’s the Difference?

Bioprocessing facilities vary significantly in size, scale, and purpose

Large-scale bioprocessing typically involves high-volume production of biologics using stainless-steel bioreactors and long-established processes. It’s favored by big pharmaceutical companies for commercial-scale manufacturing.

Small-scale bioprocessing, on the other hand, uses smaller, often single-use systems. It’s ideal for early-stage research, clinical trials, and producing small batches of personalized therapies. It also offers quicker turnaround times and lower upfront costs beneficial for biotech startups and agile R&D environments.

Both scales are essential. Large-scale setups handle global supply, while small-scale systems drive innovation and precision treatments.

How New Technology is Changing Bioprocessing

Bioprocessing is being transformed by several breakthrough technologies that enhance efficiency, reduce costs, and improve product quality:

- Single-Use Systems (SUS): These disposable bioreactors and filters minimize cleaning needs and contamination risk, making operations faster and more flexible.

- Automation and AI: Smart software and real-time monitoring tools are optimizing process control, reducing human error, and predicting outcomes.

- Continuous Bioprocessing: Instead of batch production, continuous systems allow for uninterrupted manufacturing, increasing output and lowering costs.

- Digital Twins: Virtual models of bioprocessing systems help test and refine operations without physical trials saving time and resources.

These innovations are helping companies scale up quickly while maintaining high standards of safety and compliance.

What’s Next for the Bioprocessing Industry?

The future of bioprocessing is bright and full of possibilities. Key developments to watch include

- Personalized Biomanufacturing: Tailored therapies will push demand for more flexible, small-batch, and localized production setups.

- Green Bioprocessing: Sustainable practices, including waste reduction and energy efficiency, will become industry priorities.

- Decentralized Facilities: Modular and mobile units will allow production closer to patients or in underserved regions.

- Global Collaboration: Increasing partnerships between biotech firms, government agencies, and academic institutions will accelerate innovation and scale.

Applications in the U.S. Large and Small-scale Bioprocessing Market

Bioprocessing plays a vital role across multiple areas of modern biotechnology and pharmaceutical manufacturing. One of the most significant applications is in monoclonal antibody production, which is widely used for treating cancer, autoimmune diseases, and other chronic conditions. These complex biologics require highly controlled and scalable bioprocessing environments to ensure consistency and efficacy.

Another major area is vaccine manufacturing, where bioprocessing technologies enable rapid and safe production of both traditional and next-generation vaccines, including mRNA-based platforms. This was especially crucial during the COVID-19 pandemic.

Gene and cell therapy production is also gaining momentum. These personalized and highly targeted treatments rely on precise bioprocessing methods to ensure cell viability and therapeutic potency. Likewise, enzyme and protein engineering uses bioprocessing to develop industrial enzymes and specialized proteins used in medicine, diagnostics, and food processing.

U.S. Large and Small-scale Bioprocessing Market Dynamics

Drivers

One of the primary drivers of the U.S. bioprocessing market is the surging demand for biologics and personalized medicine. Biologics have become essential in treating chronic diseases like cancer, autoimmune disorders, and rare genetic conditions. As healthcare shifts toward more tailored treatments, the need for flexible and scalable bioprocessing systems continues to rise.

Technological advancements in bioreactor design and control systems are significantly enhancing production capabilities. Modern systems now offer improved monitoring, automation, and scalability, which increase efficiency while ensuring product consistency and safety.

Opportunities

There is substantial opportunity in the expansion of biosimilar production, especially as patents for several high-revenue biologics are nearing expiration. This creates a competitive environment where manufacturers can offer more affordable versions of complex therapies, increasing market accessibility.

The development of continuous manufacturing techniques is another promising area. Unlike traditional batch production, continuous processes enhance throughput, reduce waste, and ensure consistent quality making them a future-ready solution for high-demand therapies.

Challenges

One of the key challenges in the bioprocessing market is the high capital investment required for large-scale infrastructure. Setting up biomanufacturing facilities involves significant costs related to equipment, compliance, and skilled labor—making it difficult for smaller firms to enter the market.

The industry also faces complex regulatory and quality compliance requirements. Bioprocessing operations must adhere to stringent guidelines for safety, efficacy, and traceability, which can slow down production timelines and increase operational costs.

Case Study Accelerating COVID-19 Vaccine Production

During the COVID-19 pandemic, the U.S. rapidly scaled up vaccine production using both large and small-scale bioprocessing facilities. Moderna, for instance, utilized modular and single-use bioreactor systems to expedite production timelines. In parallel, smaller biotech firms partnered with CDMOs to support manufacturing, showcasing the agility and scalability of the U.S. bioprocessing ecosystem.

Read More:https://www.heathcareinsights.com/u-s-antibody-drug-conjugates-market/

Top Companies in U.S. Large and Small-scale Bioprocessing Market

- Merck KGaA

- Thermo Fisher Scientific, Inc.

- Danaher (Cytiva)

- Corning Inc.

- Sartorius AG

- Lonza

- Eppendorf AG

- Getinge AB

- PBS Biotech, Inc.

- Meissner Filtration Products, Inc.

- Entegris

- Saint-Gobain

- Repligen Corporation

- Avantor, Inc.

- Distek, Inc.

- F. Hoffmann-La Roche Ltd

- Bio-Synthesis, Inc.

Want custom data? Click here: https://www.visionresearchreports.com/report/customization/41774

U.S. Large and Small-scale Bioprocessing Market Segmentation

By Scale

- Industrial Scale (Over 50,000 Liter)

- Small Scale (Less Than 50,000 Liter)

By Workflow

- Downstream Processing

- Fermentation

- Upstream Processing

By Product

- Bioreactors/Fermenters

- Cell Culture Products

- Filtration Assemblies

- Bioreactors Accessories

- Bags & Containers

- Others

By Application

- Biopharmaceuticals

- Speciality Industrial Chemicals

- Environmental Aids

By Use-Type

- Multi-Use

- Single-Use

By Mode

- In-House

- Outsourced

Future Outlook

The next decade will see the U.S. bioprocessing market evolve into a more agile, digitally connected, and innovation-driven sector. The integration of AI, continuous processing, and personalized biomanufacturing will become more mainstream. Furthermore, public-private collaborations will play a vital role in reshaping the biomanufacturing infrastructure, ensuring readiness for emerging health challenges.

Buy this Premium Research Report@https://www.visionresearchreports.com/report/checkout/41774

You can place an order or ask any questions, please feel free to contact

sales@visionresearchreports.com| +1 650-460-3308