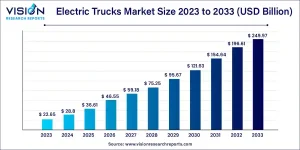

The global electric trucks market was valued at approximately USD 22.65 billion in 2023 and is expected to reach around USD 249.97 billion by 2033, expanding at a compound annual growth rate (CAGR) of 27.14% from 2024 to 2033. This remarkable growth is driven by stringent environmental regulations, rapid advancements in battery technology, and an increasing global shift toward sustainable transportation. Electric trucks including light, medium, and heavy-duty variants are emerging as a critical solution to lowering carbon emissions in the transport sector. By operating on electricity instead of fossil fuels, these vehicles offer a cleaner alternative with significantly reduced emissions and lower long-term operating costs.

Electric Trucks Market Overview

The electric trucks market is undergoing a significant transformation, driven by global efforts to reduce carbon emissions and improve fuel efficiency in the transportation sector. As a clean and sustainable alternative to traditional diesel-powered trucks, electric trucks are gaining traction in both commercial and logistics industries.

In 2023, the global electric trucks market was valued at approximately USD 22.65 billion. It is expected to reach nearly USD 249.97 billion by 2033, expanding at a robust CAGR of 27.14% from 2024 to 2033. This exponential growth reflects both technological advancements and a shift in industry priorities toward sustainability and cost-effectiveness.

Get a Sample@ https://www.visionresearchreports.com/report/sample/41630

Electric Trucks Market Growth

The growth of the electric trucks market is being fueled by a surge in government initiatives, stringent emission regulations, and increasing investments in charging infrastructure. Nations across Europe, North America, and Asia Pacific are pushing for electrification in freight transportation as part of their climate action plans. Additionally, fleet operators are adopting electric trucks to lower operational costs and meet ESG (Environmental, Social, and Governance) targets.

Another key driver is the rapid evolution of battery technology, which has significantly improved driving ranges and reduced charging times. Coupled with falling battery prices and advancements in powertrain systems, electric trucks are becoming more practical and economically viable for long-haul and last-mile deliveries alike. This has encouraged major OEMs and startups to expand their electric truck portfolios and invest heavily in R&D.

Electric Trucks Market Trends

- OEM Expansion into Electric Fleets: Traditional truck manufacturers are rapidly introducing electric models to stay competitive, often in partnership with battery and software providers.

- Advancements in Solid-State Batteries: Ongoing research into solid-state batteries promises higher energy density, improved safety, and longer lifespans, which will greatly benefit electric truck performance.

- Increased Focus on Last-Mile Delivery Solutions: The boom in e-commerce is driving demand for electric light-duty trucks optimized for urban last-mile logistics.

- Charging Infrastructure Development: Companies and governments are investing in public and private fast-charging networks, particularly at logistics hubs and highways, to support fleet electrification.

What Are Electric Trucks and Why Do They Matter?

Electric trucks are commercial vehicles powered by electric batteries rather than diesel or gasoline. They come in various sizes, from light-duty vans to heavy-duty freight haulers. These trucks offer a clean, quiet, and energy-efficient alternative to traditional trucks, helping reduce greenhouse gas emissions and air pollution.

They matter because the transportation sector is one of the largest contributors to carbon emissions. By switching to electric trucks, companies and governments can significantly lower their environmental impact while also reducing fuel and maintenance costs over time.

How Big Is the Electric Trucks Market?

The electric trucks market is growing fast and attracting global attention. As of 2023, the market was valued at around USD 22.65 billion. With strong momentum, it’s expected to reach approximately USD 249.97 billion by 2033, growing at a CAGR of 27.14% from 2024 to 2033.

This rapid expansion is being fueled by stricter environmental regulations, rising fuel prices, and growing interest in clean energy vehicles for logistics, delivery, and heavy-duty transport.

Types of Electric Trucks in the Market

Electric trucks are categorized based on their vehicle size, powertrain technology, and intended use. Each type serves a different purpose, catering to the diverse needs of commercial and industrial transportation.

Light-Duty Electric Trucks

- These are small trucks typically used for last-mile delivery, postal services, and urban logistics.

- Commonly used by e-commerce, food delivery, and courier companies.

- Operate efficiently in congested urban areas with frequent stop-and-go traffic.

- Lower battery capacity but sufficient for short routes (typically under 150 miles per charge).

Examples Rivian EDV, Ford E-Transit, BYD T3

Medium-Duty Electric Trucks

- Medium-duty electric trucks are ideal for intra-city cargo movement, municipal services, and short-range freight.

- Often used by local government bodies for garbage collection or street maintenance.

- Can carry heavier loads than light-duty trucks while offering longer range and higher torque.

- More robust design suitable for delivery routes with moderate cargo.

Examples Freightliner eM2, Renault Trucks D Z.E., Isuzu NPR EV

Heavy-Duty Electric Trucks

- These trucks are built for long-haul transport, construction, mining, and industrial logistics.

- Feature larger batteries and stronger motors to handle heavy cargo over long distances.

- Typically equipped with regenerative braking systems to improve energy efficiency.

- Require advanced charging infrastructure like megawatt chargers (MCS) for rapid refueling.

Examples Tesla Semi, Volvo FH Electric, Mercedes-Benz eActros

Battery Electric Trucks (BEVs)

- BEVs are fully electric and powered by onboard lithium-ion or solid-state batteries.

- Produce zero tailpipe emissions and operate quietly.

- Require external charging stations (Level 2, DC fast chargers, or high-power fleet depots).

- Suitable for fleets aiming for 100% clean transportation.

Advantages: Low maintenance, government incentives, instant torque

Limitation: Range anxiety if infrastructure is lacking

Electric Trucks Market Dynamics

Drivers

- Rising fuel prices and total cost of ownership (TCO) advantages: The consistent rise in diesel and gasoline prices has made electric trucks a more attractive option due to their lower operating and maintenance costs. Over time, electric trucks offer better total cost of ownership, especially for companies managing large fleets and short-range delivery operations.

- Government incentives and zero-emission mandates: Many governments across North America, Europe, and Asia are offering financial incentives, tax credits, and subsidies to promote the adoption of electric commercial vehicles. In parallel, stricter emission regulations and zero-emission vehicle (ZEV) mandates are compelling manufacturers and fleet operators to transition toward electric trucks.

Opportunities

- Integration of AI and telematics for fleet optimization: The integration of artificial intelligence (AI), IoT, and telematics is unlocking new possibilities for electric truck fleets. These technologies can improve route planning, monitor battery health, predict maintenance needs, and enhance overall efficiency, making fleet management smarter and more cost-effective.

- Expanding market in emerging economies: Emerging markets in Asia, Latin America, and Africa are beginning to embrace electrification in commercial transport. As infrastructure improves and vehicle costs decline, these regions offer significant growth opportunities for manufacturers and investors.

Challenges

- High upfront costs of electric trucks: Despite long-term savings, the initial purchase cost of electric trucks remains significantly higher than their diesel counterparts. This continues to be a major barrier for small and mid-sized businesses with limited capital or access to financing.

- Limited charging infrastructure, especially in rural areas: A well-developed charging network is crucial for the widespread adoption of electric trucks. While progress is being made in urban and highway areas, rural regions still lack the infrastructure needed to support commercial electric vehicle fleets.

Key Factors Impacting the Market (Good and Bad)

Positive Factors

- Government incentives and green policies: Many countries are offering subsidies, tax rebates, and grants to accelerate the shift to electric trucks. Policies like zero-emission vehicle (ZEV) mandates and carbon credit programs are further boosting adoption.

- Falling battery costs: Thanks to advancements in battery chemistry and mass production, the cost of lithium-ion batteries has dropped significantly. This makes electric trucks more accessible, particularly for fleet operators.

- Corporate ESG goals: Major logistics, retail, and manufacturing companies are incorporating electric trucks into their fleets to meet environmental, social, and governance (ESG) commitments and align with global sustainability targets.

Challenges

- High upfront cost of electric trucks: Despite lower operating costs, electric trucks still have a higher initial purchase price due to expensive battery systems, which can deter small businesses from investing.

- Limited charging infrastructure: Charging networks are still under development in many regions, especially for heavy-duty and long-haul electric trucks that require high-capacity, fast-charging stations along highways.

- Battery lifespan and recycling concerns: The long-term sustainability of EV batteries is still a challenge. Degradation over time reduces performance, and the lack of efficient recycling systems creates environmental and safety concerns.

Applications in the Market

Electric trucks are finding widespread use across various industries due to their environmental benefits and cost efficiency. In the logistics and delivery sector, they are increasingly being used for short- and mid-range freight transportation. Logistics companies are deploying electric trucks to reduce fuel expenses and cut carbon emissions, especially for urban and regional distribution routes.

In municipal services, electric trucks are playing a vital role in city operations. Vehicles such as electric garbage trucks, street sweepers, and maintenance units are gaining traction in municipalities focused on sustainability and clean city initiatives. These vehicles operate quietly and produce zero tailpipe emissions, making them ideal for densely populated urban areas.

Case Study Volvo’s Electric Truck Rollout in Europe

In 2022, Volvo Trucks launched a series of electric heavy-duty trucks across several European countries, targeting major logistics companies. By collaborating with logistics providers like DHL and DFDS, Volvo successfully deployed electric trucks for regional and urban freight transport. The initiative led to significant reductions in CO₂ emissions and operating costs, while also demonstrating the feasibility of electrification in medium- and long-haul applications. The partnership helped Volvo gather valuable performance data, which was used to refine its product offerings and plan for further expansion.

Read More:https://www.heathcareinsights.com/led-modular-display-market/

Top Manufactures in Electric Trucks Market

- AB Volvo

- BYD Company Ltd.

- Daimler Truck AG

- Dongfeng Motor Company

- FAW Group Co., Ltd.

- Foton International

- ISUZU MOTORS LIMITED

- Navistar, Inc.

- PACCAR Inc.

- Scania

Want custom data? Click here: https://www.visionresearchreports.com/report/customization/41630

Electric Trucks Market Segmentation

By Vehicle

- Light Duty Trucks

- Medium Duty Trucks

- Heavy Duty Trucks

By Propulsion

- BEV

- PHEV

- HEV

By Vehicle Range

- Up to 300 miles

- 300-600 miles

- Above 600 miles

By Application

- Logistics & Delivery

- Construction

- Waste Management

- Others

Regional Analysis

- North America

North America is at the forefront of electric truck adoption, thanks to a combination of regulatory mandates, corporate sustainability commitments, and federal/state-level incentives. In the United States, states like California, New York, and Washington have implemented strict zero-emission vehicle (ZEV) regulations, including the Advanced Clean Trucks (ACT) rule, requiring manufacturers to sell an increasing percentage of electric trucks.

Fleet electrification is gaining traction among logistics giants like Amazon, UPS, and FedEx.

Canada is following a similar trajectory, with a national strategy for zero-emission vehicles and funding for charging infrastructure.

Heavy investment in charging corridors along highways is supporting long-haul electric truck deployment.

- Europe

Europe is a leader in policy-driven electrification, backed by the European Green Deal, which targets climate neutrality by 2050. The EU’s CO₂ emissions standards for heavy-duty vehicles are pushing OEMs and fleet operators to invest in zero-emission trucks.

Countries like Germany, Norway, the Netherlands, and Sweden are aggressively investing in charging stations, hydrogen refueling networks, and electric freight trials.

Urban low-emission zones (LEZs) and congestion charges are driving the adoption of electric delivery trucks.

European manufacturers such as Volvo, Renault Trucks, and Daimler are advancing their electric truck portfolios, including heavy-duty and regional haul models.

- Asia Pacific

Asia Pacific is projected to be the fastest-growing region in the electric trucks market. China is leading global adoption, with extensive government subsidies, emission mandates, and infrastructure investments.

China has already deployed hundreds of thousands of electric commercial vehicles, especially in cities like Shenzhen and Beijing.

The Chinese government is offering incentives for manufacturers, while local governments support fleet conversion for public transport and urban logistics.

India is gradually scaling up its electric truck efforts through programs like FAME II, although infrastructure and affordability remain key challenges.

Japan and South Korea are investing in hydrogen fuel cell trucks and battery innovation, targeting both domestic use and export markets.

- Latin America & Middle East

These regions are in the early stages of electric truck adoption but show increasing interest due to urban air pollution, import fuel dependency, and rising sustainability goals.

In Latin America, countries like Chile, Brazil, and Mexico are initiating electric bus and truck pilot projects. Chile, for instance, has ambitious plans for electric public and commercial fleets by 2030.

In the Middle East, the UAE and Saudi Arabia are exploring electric mobility as part of their national visions (e.g., Vision 2030) and have begun testing electric delivery trucks for urban transport.

Future Outlook

The electric trucks market is poised for unprecedented growth in the next decade. As technology matures and economies of scale bring down vehicle and battery costs, adoption will accelerate across a broad range of industries. Autonomous driving features, integration with smart city systems, and connected fleet management solutions will further enhance the appeal of electric trucks. In the long run, zero-emission trucking will become a standard, not a trend, reshaping global supply chains and urban mobility systems.

Buy this Premium Research Report@https://www.visionresearchreports.com/report/checkout/41630

You can place an order or ask any questions, please feel free to contact

sales@visionresearchreports.com| +1 650-460-3308