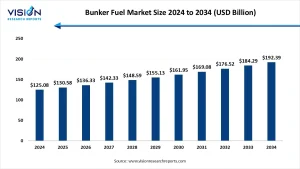

The global bunker fuel market size was valued at around USD 125.08 billion in 2024 and it is projected to hit around USD 192.39 billion by 2034, growing at a CAGR of 4.40% from 2025 to 2034.

Get a Sample@https://www.visionresearchreports.com/report/sample/41701

Bunker fuel plays a pivotal role in global maritime transportation, serving as the primary fuel source for ships. With growing international trade and expanding shipping activities, the demand for bunker fuel has surged globally. The market encompasses different fuel types including high-sulfur fuel oil (HSFO), low-sulfur fuel oil (LSFO), marine gas oil (MGO), and others, which are vital for powering vessels and meeting maritime energy requirements.

In 2024, the global bunker fuel market was valued at approximately USD 125.08 billion, and it is projected to reach around USD 192.39 billion by 2034, registering a CAGR of 4.40% during the forecast period from 2025 to 2034. This growth reflects both the increasing demand for maritime freight transport and the evolving regulations aimed at reducing carbon emissions in shipping.

Bunker Fuel Market Growth

The bunker fuel market is witnessing consistent growth driven by the expansion of international trade routes and increased cargo shipping traffic. As economies become more interconnected, seaborne trade continues to dominate the global logistics chain, fueling the demand for bunker fuels. Additionally, growth in emerging markets, especially in the Asia-Pacific region, has led to a significant rise in shipping activity, bolstering fuel consumption.

Furthermore, regulatory shifts by the International Maritime Organization (IMO) aimed at reducing sulfur content in marine fuels have led to the development and adoption of cleaner fuel alternatives. This transition, though challenging, is opening up new avenues for market expansion, particularly for low-sulfur fuel oils and bio-based marine fuels. The shift also drives investments in refining technologies and scrubber systems across ports and vessels worldwide.

Bunker Fuel Market Dynamics

Drivers

- Growth in international maritime trade and cargo shipping

- IMO regulations fostering demand for cleaner, compliant fuel types

- Expansion of seaborne oil and gas transport

Opportunities

- Development of renewable and alternative bunker fuels

- Technological advancements in fuel-efficient engines and vessels

- Emerging markets in Asia, Africa, and Latin America

Challenges

- High operational costs of fuel-compliant retrofits and scrubber installations

- Volatility in crude oil prices affecting bunker fuel costs

- Limited availability of infrastructure for LNG and other alternative fuels

Bunker Fuel Market Trends

- Rising adoption of low-sulfur and alternative fuels such as LNG, methanol, and biofuels in response to IMO 2020 regulations.

- Increasing investment in scrubber technologies for existing vessels to comply with environmental regulations while still using HSFO.

- Digitalization and automation in fuel management to enhance efficiency, reduce waste, and monitor emissions.

- Geopolitical influences on fuel supply chains causing fluctuations in bunker fuel prices and availability in key maritime regions.

Recent Key Strategies and Developments in Market

- Shell & Hapag-Lloyd Agreement (Feb 2023): Shell Western LNG B.V and Hapag-Lloyd signed a multi-year LNG supply agreement for ultra-large dual-fuel container vessels (23,500+ TEU). Bunkering operations began in H2 2023 at the Port of Rotterdam, with vessels operating on the Europe–Far East route.

- TotalEnergies Expands LNG Network (Nov 2022): TotalEnergies held a naming ceremony for the Brassavola LNG bunker vessel in Singapore, marking a key step in expanding its global LNG bunkering infrastructure.

- Shell & CMA CGM Collaboration (June 2022): Shell and CMA CGM Group entered a multi-year LNG supply partnership to support decarbonization in shipping. The agreement covers LNG bunkering for CMA CGM’s 13,000 TEU vessels at the Port of Singapore, starting in H2 2023.

Read More: https://www.heathcareinsights.com/beet-sugar-market/

Top Companies in Bunker Fuel Market

- BP Marine

- Chevron Corporation

- Royal Dutch Shell Plc

- ExxonMobil Corporation

- TotalEnergies SE

- Gazprom Neft PJSC

- China Marine Bunker (CHIMBUSCO)

- World Fuel Services Corporation

- Aegean Marine Petroleum Network Inc.

- PetroChina Company Limited

- Bunker Holding A/S

- Neste Corporation

- GAC Bunker Fuels Ltd.

- Lukoil-Bunker LLC

Bunker Fuel Market Segments

- By Fuel Type: High Sulfur Fuel Oil (HSFO), Low Sulfur Fuel Oil (LSFO), Marine Gas Oil (MGO), Liquefied Natural Gas (LNG), Others

- By Vessel Type: Containers, Tankers, General Cargo, Bulk Carriers, Others

- By Seller: Major Oil Companies, Independent Sellers, Traders

- By End Use: Commercial, Military

Future Outlook

The bunker fuel market is poised for transformation over the next decade, driven by a blend of regulatory pressures and technological innovations. As environmental compliance becomes stricter, the industry will likely move toward decarbonization through cleaner fuels and energy-efficient vessels. Market players are expected to invest in R&D, LNG bunkering infrastructure, and digital platforms to remain competitive and sustainable. The transition will be gradual but inevitable, shaping the future of maritime fuel consumption and trade dynamics.

Buy this Premium Research Report@https://www.visionresearchreports.com/report/checkout/41701

You can place an order or ask any questions, please feel free to contact

sales@visionresearchreports.com| +1 650-460-3308