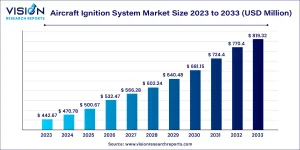

The global aircraft ignition system market stood at USD 442.67 million in 2023 and is anticipated to reach USD 819.32 million by 2033, registering a CAGR of 6.35% during 2024–2033.

The market is driven by the growing need for airlines to reduce maintenance costs without compromising safety, coupled with the rising number of aging aircraft requiring frequent part replacements. Increasing fleet expansion in emerging regions, along with the shift toward sustainability and cost-efficient maintenance solutions, further fuels the demand for used serviceable materials (USM) in aviation.

Air Ignition System Market Overview

The global air transport used serviceable material (USM) market plays a crucial role in the aviation industry, ensuring the availability of cost-effective spare parts while maintaining safety and performance standards. Airlines and MRO (Maintenance, Repair, and Overhaul) providers rely heavily on USM components to reduce operational expenses, extend aircraft life cycles, and improve overall efficiency. With the growing demand for commercial and cargo flights, coupled with an increasing fleet of aging aircraft, the importance of the USM market is greater than ever.

According to recent market analysis, the global air transport USM market was valued at USD 7.93 billion in 2023 and is projected to surpass USD 12.36 billion by 2033, registering a CAGR of 4.54% from 2024 to 2033.

Air Ignition System Market Growth

The consistent expansion of global air passenger traffic, particularly in emerging economies, is driving the demand for cost-efficient aviation solutions. As airlines look for ways to optimize expenses, USM offers a reliable option by providing high-quality, certified spare parts at a fraction of the cost of new ones.

Additionally, the aftermarket sector in aviation is experiencing strong growth due to rising fleet modernization and the need for effective maintenance solutions. The USM market is benefiting from collaborations between OEMs and MRO service providers, helping airlines reduce turnaround time and improve operational reliability.

Get a Sample@ https://www.visionresearchreports.com/report/sample/41530

Air Ignition System Market Trends

- Growing Focus on Sustainability: Airlines are increasingly opting for USM parts to minimize waste and reduce the carbon footprint, supporting aviation industry sustainability goals.

- Rising Demand from Low-Cost Carriers: Budget airlines are leveraging USM components to keep operational costs low while maintaining fleet safety and compliance.

- Digitalization of Supply Chain: Platforms using AI and blockchain are enhancing transparency, part traceability, and efficiency in USM procurement.

- Increase in Engine and Component Teardowns: With older aircraft being retired, more serviceable parts are entering the market, creating a wider pool of available USM inventory.

What is the Main Advantage of Air Transportation?

The biggest advantage of air transportation is speed and global reach. Unlike roadways, railways, or shipping, air transport allows passengers and cargo to travel across continents in just a few hours. This capability is especially critical in today’s interconnected world, where businesses rely on fast logistics to serve international markets.

For businesses, this means:

- Quicker delivery times, ensuring fresh and time-sensitive products like pharmaceuticals, electronics, and perishables reach customers on time.

- Global market access, enabling trade between countries and regions that would otherwise be difficult due to distance.

- Efficient supply chain management, reducing storage costs and ensuring just-in-time deliveries.

What is the Main Focus of Air Transport?

The primary focus of air transport is to ensure the safe, efficient, and reliable movement of people and goods while meeting international aviation standards. Airlines and aviation authorities place strong emphasis on passenger safety through strict protocols, regular aircraft inspections, and adherence to airworthiness regulations. At the same time, fleet maintenance is prioritized to keep aircraft in peak condition, minimizing downtime and disruptions. Another core focus is timeliness and reliability, as punctual services help strengthen customer trust and business efficiency. With environmental concerns rising, the industry is also shifting toward sustainability by investing in greener aircraft, optimizing fuel efficiency, and adopting sustainable aviation fuels (SAF). In parallel, digital innovation plays a growing role, with AI, IoT, and advanced analytics transforming ticketing, baggage handling, predictive maintenance, and overall passenger experience.

What are the Three Types of Air Transportation?

Air transportation can be broadly classified into three key categories, each serving unique purposes:

Passenger Air Transport: This is the most widely recognized form of air transportation, responsible for moving people across cities, countries, and continents. It includes:

- Commercial airlines (economy, business, and first-class services)

- Regional airlines connecting smaller cities

- Charter flights and private jets for luxury or corporate travel

Cargo Air Transport: This sector focuses on the transportation of goods and freight. It plays a critical role in international trade and supply chains by delivering:

- Perishable goods like fruits, vegetables, and seafood

- High-value items such as electronics and pharmaceuticals

- Industrial equipment, e-commerce shipments, and humanitarian aid supplies

Military Air Transport: Dedicated to defense and national security, military air transport ensures the rapid movement of troops, weapons, equipment, and humanitarian aid in times of conflict or disaster. This includes:

- Tactical and strategic airlift operations

- Medical evacuation flights

- Peacekeeping and disaster relief missions

Air Ignition System Market Dynamics

Drivers

The air transport USM market is primarily driven by the increasing pressure on airlines to cut operational costs while maintaining strict safety and quality standards. As aviation fuel and labor costs rise, USM offers a cost-effective solution by providing certified, reliable spare parts at a fraction of the price of new components.

Another major driver is the global fleet expansion. Regions like Asia-Pacific and the Middle East are witnessing exponential growth in both passenger and cargo flights, creating high demand for cost-efficient maintenance solutions. Additionally, the surge in aging aircraft and growing retirements provide a continuous supply of serviceable components, strengthening the USM market’s backbone.

Opportunities

The USM market is at the forefront of digital transformation. Innovations such as predictive analytics, AI-driven inventory management, and blockchain-enabled part traceability are unlocking new levels of efficiency and trust. Airlines and MRO providers can now forecast part requirements, minimize downtime, and ensure seamless compliance with airworthiness regulations.

E-commerce platforms dedicated to aviation spare parts are also gaining traction, creating a global marketplace for certified USM components. This shift toward digital platforms enhances transparency, speeds up transactions, and expands accessibility for small and mid-sized airlines that previously faced sourcing challenges. Furthermore, the growing sustainability agenda in aviation offers an opportunity for USM to be positioned as an eco-friendly choice, reducing manufacturing-related carbon emissions.

Challenges

Despite its growth potential, the USM market faces notable challenges. The foremost issue is ensuring authenticity, quality assurance, and traceability of used parts. Airlines must comply with rigorous aviation regulations, and any lack of proper certification can lead to trust issues, slowing adoption in certain markets.

Another challenge lies in supply fluctuations. The availability of serviceable materials is closely tied to aircraft retirements and teardowns. During periods of low retirements, the market may face shortages, leading to price volatility.

By integrating USM into its maintenance operations, Delta has been able to extend fleet life while aligning with sustainability goals by reducing waste.

make more with title

Want custom data? Click here: https://www.visionresearchreports.com/report/customization/41530

Case Study Delta Air Lines’ Strategic Use of USM

Delta Air Lines stands out as a leading example of how airlines can successfully integrate USM into their maintenance strategy. Faced with rising maintenance costs and an expanding fleet, Delta adopted a proactive approach by partnering with leading MRO providers to secure a steady supply of high-quality serviceable parts.

Through this initiative, the airline has been able to reduce overall maintenance expenses by millions of dollars annually, while also cutting turnaround times for aircraft servicing. This not only improves operational efficiency but also ensures minimal downtime for its fleet.

Delta has also emphasized sustainability benefits, using USM parts to reduce the demand for new component manufacturing, thereby lowering carbon emissions and waste. By extending the life cycle of its aircraft and aligning with global green aviation goals, the airline has positioned itself as a forward-thinking leader in fleet management.

In addition, Delta’s investment in predictive maintenance tools, combined with USM adoption, has enhanced the airline’s ability to anticipate part replacement needs, streamline inventory, and maximize aircraft availability. This strategic blend of technology and cost-effective components demonstrates how USM can serve as both an economic and environmental advantage in modern aviation.

Air Ignition System Market Regional Analysis

- North America

North America currently dominates the global air transport USM market, thanks to its vast network of airlines, a significant number of aging aircraft, and a mature MRO (Maintenance, Repair, and Overhaul) ecosystem. The U.S. remains the hub of activity, with major players, aircraft teardown facilities, and strong regulatory oversight that ensures a steady supply of serviceable parts. Additionally, airlines in the region are actively investing in digital platforms to streamline USM procurement, further strengthening market growth.

- Europe

Europe follows closely, fueled by the region’s strong commitment to sustainability and circular economy principles. Airlines are increasingly incorporating USM to meet strict emission reduction targets while cutting costs. Legacy carriers, such as Lufthansa and Air France-KLM, have been pioneers in adopting USM for their MRO operations. Moreover, the European aviation aftermarket is benefitting from supportive government regulations, a rising focus on green aviation, and partnerships between OEMs and independent MRO service providers.

- Asia-Pacific

Asia-Pacific is projected to witness the fastest growth rate in the air transport USM market. This surge is driven by the rapid expansion of fleets, particularly in China, India, and Southeast Asian countries, coupled with the rising presence of low-cost carriers. Increasing passenger traffic, fleet modernization initiatives, and new aircraft deliveries are contributing to higher demand for cost-efficient maintenance solutions. The region is also witnessing an increase in teardown activities as older fleets are gradually phased out, creating new opportunities for USM suppliers.

- Middle East & Africa

The Middle East and Africa present significant growth opportunities due to the establishment of major aviation hubs in countries like the UAE, Qatar, and Saudi Arabia. Airlines in the Gulf region are investing heavily in state-of-the-art maintenance facilities to cater not only to their fleets but also to international carriers. Africa, though still in the early stages of USM adoption, is showing promise with rising air travel demand, government-backed aviation infrastructure projects, and increasing interest from global MRO companies looking to expand into emerging markets.

- Latin America

Latin America, while relatively smaller compared to other regions, is steadily gaining traction in the USM market. Countries such as Brazil and Mexico, with their growing aviation sectors and low-cost carrier dominance, are increasingly turning to USM to optimize maintenance costs. The market here is also supported by partnerships with North American suppliers, allowing airlines to gain quicker access to certified parts.

Read More: https://www.heathcareinsights.com/india-single-use-bioprocessing-sensors/

Top Key Players in Aircraft Ignition System Market?

- Sonex LLC

- Champion Aerospace Inc

- Electroair Acquisition Corp

- PBS Group AS

- Tempest Aero Group LLC

- Surefly Partners Ltd

- Unison Industries LLC

- FADEC International LLC

- Kelly Aerospace Inc

Aircraft Ignition System Market Segmentation

By Type

- Electric Ignition

- Magneto Ignition

By Component

- Ignition Leads

- Igniters

- Spark Plugs

- Exciters

- Others

By Engine Type

Turboprop Engine

Turbofan Engine

Turbojet Engine

Piston Engine

By Region

- North America

- Europe

- Asia-Pacific

- South and Central America

- Middle East and Africa

Future Outlook

The next decade is expected to witness strong momentum in the USM market, fueled by the rising global air travel demand, the push for greener aviation, and technological integration into supply chains. With digital marketplaces improving trust and transparency, airlines are likely to adopt USM on a larger scale. The market will also benefit from increasing aircraft retirements, ensuring a steady flow of serviceable parts.

Buy this Premium Research Report@ https://www.visionresearchreports.com/report/checkout/41530

You can place an order or ask any questions, please feel free to contact

sales@visionresearchreports.com| +1 650-460-3308