Introduction

The automotive connectors market is rapidly evolving as the automotive industry shifts toward electrification, automation, and digital connectivity. Connectors once simple components have become critical enablers of advanced vehicle functions, from power delivery and data transmission to safety and infotainment. As modern vehicles increasingly rely on complex electronic systems, the demand for high-performance, reliable connectors is surging. This market is not only expanding due to the rise of electric and hybrid vehicles but also being reshaped by innovations in autonomous driving, smart mobility, and next-generation vehicle platforms.

Automotive Connectors Market Overview

The automotive connectors market plays a critical role in enabling the safe and efficient transmission of electrical signals and power within vehicles. These connectors are essential for systems ranging from infotainment and lighting to engine control and advanced driver-assistance systems (ADAS). With increasing electronic integration in both traditional and electric vehicles, the demand for robust, high-performance connectors continues to accelerate.

Automotive manufacturers are heavily investing in smarter, safer, and greener mobility solutions. Connectors are at the heart of this transformation, acting as the nervous system of modern vehicles. The growing push for vehicle electrification and intelligent features has turned automotive connectors from simple components into strategic enablers of innovation.

Get a Sample@https://www.visionresearchreports.com/report/sample/41602

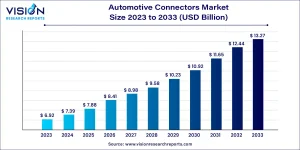

Automotive Connectors Market Growth

The automotive connectors market has witnessed strong growth in recent years, driven by the rising demand for electric vehicles (EVs), connected cars, and ADAS technologies. As the automotive sector evolves into a data-driven ecosystem, high-speed, reliable connectors have become indispensable. Tier 1 suppliers and OEMs are increasingly collaborating with connector manufacturers to ensure seamless integration of electronic systems.

Moreover, global initiatives to reduce carbon emissions have propelled the adoption of EVs and hybrid vehicles. These vehicles require more intricate wiring systems and specialized connectors for battery management, power distribution, and sensor systems, thereby expanding the market potential for connector technologies.

What Is the Automotive Connectors Market?

The automotive connectors market focuses on components that join various electrical systems in vehicles to ensure reliable power and data transmission. These connectors play a critical role in everything from basic lighting functions to sophisticated systems like ADAS, infotainment, battery management, and powertrain electronics.

As vehicles become more digitally integrated—with sensors, software, and electric propulsion systems—connectors are evolving to meet higher demands for speed, durability, and miniaturization. Their performance directly impacts vehicle safety, efficiency, and functionality, making them an essential part of modern automotive design and engineering.

Automotive Connectors Market Trends

- Electrification of Vehicles: As EVs become mainstream, high-voltage and high-temperature connectors are in high demand to support powertrain and battery systems.

- Miniaturization and High-Density Designs: There’s a growing trend toward compact connectors that can handle higher data rates and power within smaller footprints.

- Increased Adoption of ADAS and Autonomous Features: Vehicles now require complex sensor and camera networks, boosting demand for specialized data and signal connectors.

- Sustainability and Material Innovation: Manufacturers are exploring recyclable materials and lead-free alternatives for eco-friendly connector solutions.

Different Types of Automotive Connectors

Automotive connectors vary based on their function, voltage capacity, signal type, and installation location within the vehicle. As vehicles become more electrified and digitally connected, the diversity and complexity of connectors are increasing. Below are some of the key types with detailed insights:

- PCB (Printed Circuit Board) Connectors: PCB connectors form the bridge between various electronic control units (ECUs) and the circuit boards that manage critical vehicle functions.

- Engine management systems

- Instrument clusters

- Infotainment and navigation systems

- Climate control modules

These connectors must support high-density, multi-pin configurations and offer excellent mechanical stability and vibration resistance.

- Wire-to-Wire Connectors: Wire-to-wire connectors are the most common type, linking individual wires across various vehicle systems. They play a vital role in

- Headlights and taillights

- HVAC units

- Power windows and door locks

- Audio systems

Designed for both low and high-current applications, these connectors often feature locking mechanisms and seals to withstand harsh automotive environments.

- Wire-to-Board Connectors: These connectors link wiring harnesses to printed circuit boards, facilitating communication between physical vehicle components and onboard electronic systems.

- Airbag control systems

- Parking sensors

- Seat control modules

- In-cabin displays and infotainment units

Wire-to-board connectors are designed for quick assembly and often incorporate anti-vibration features and terminal position assurance (TPA) systems.

Where Are Connectors Used in Vehicles?

Automotive connectors are essential components that ensure the secure transmission of electrical signals and power between vehicle systems. As modern vehicles evolve into high-tech machines, connectors play a vital role in enabling both functionality and safety. From basic mechanical functions to complex autonomous features, connectors are found throughout every corner of the vehicle.

- Powertrain & Battery Systems: Connectors in powertrain and battery systems are especially critical in electric and hybrid vehicles. These high-voltage connectors handle energy transfer between

- Battery packs and inverters

- Inverters and electric motors

- Charging ports and onboard chargers

They are designed to withstand high current loads, thermal stress, and electromagnetic interference. These connectors also include safety features such as shielding, sealing, and interlock systems to prevent accidental disconnection or arcing.

- Infotainment & Telematics: Infotainment systems rely on a range of connectors to ensure smooth communication and entertainment experiences. These connectors handle

- Audio and video streaming

- GPS navigation

- Touchscreen interfaces

- Smartphone integration (Apple CarPlay, Android Auto)

- Internet and Bluetooth connectivity

Modern vehicles also incorporate telematics control units (TCUs) that provide remote diagnostics, vehicle tracking, and over-the-air (OTA) updates—all made possible by high-speed data connectors.

- ADAS & Sensor Networks: Advanced Driver-Assistance Systems (ADAS) require an intricate network of sensors and processors. Connectors in this area are tasked with handling data from:

- Cameras (for lane assist, parking, 360° view)

- Radar and LiDAR units (for adaptive cruise control, collision detection)

- Ultrasonic sensors (for obstacle detection and automatic braking)

These systems require high-bandwidth, low-latency connectors capable of supporting real-time data flow with absolute reliability and resistance to interference.

- Lighting Systems: Lighting systems in vehicles—both interior and exterior—depend on sealed connectors for long-term durability. They are used in:

- Headlights (halogen, LED, matrix, laser)

- Taillights and brake lights

- Daytime running lights (DRLs)

- Cabin and ambient lighting

These connectors must be water-resistant and corrosion-proof, especially in exterior applications where exposure to dirt, moisture, and temperature extremes is common.

Automotive Connectors Market Dynamics

Drivers

The shift toward connected and electric mobility continues to be a major driver of the automotive connectors market. Today’s vehicles are increasingly dependent on electronic components for everything from engine performance to driver assistance features. This rise in electrical complexity means vehicles require a greater number of high-performance connectors that can handle data, power, and signal transmission seamlessly.

Government regulations also play a vital role. Stringent safety standards (like Euro NCAP and NHTSA requirements) and environmental policies (such as CO₂ emission caps and zero-emission vehicle mandates) are pushing automakers to integrate more electronic systems—fueling demand for advanced connectors. In addition, the growth of in-car infotainment, telematics, and over-the-air (OTA) update capabilities is further intensifying the need for reliable, compact, and high-speed connectors.

Opportunities

Emerging economies like India, Brazil, and several Southeast Asian countries are expected to become major growth hubs for the automotive connectors market. Rising disposable incomes, favorable government policies, and expanding local manufacturing ecosystems are setting the stage for rapid adoption of EVs and tech-enabled vehicles in these regions.

Furthermore, the push toward autonomous and shared mobility opens up a new design frontier. Self-driving cars, robotaxis, and fleet vehicles require complex electronic frameworks, demanding unique and highly specialized connectors. There is also a growing opportunity for innovation in wireless and modular connectors that can simplify vehicle architecture while supporting new-age vehicle platforms.

Technological advancements such as 5G integration, vehicle-to-everything (V2X) communication, and predictive maintenance systems will also create opportunities for smarter, data-rich connectors to support the next wave of automotive innovation.

Challenges

Despite strong growth prospects, the automotive connectors market faces several key challenges. One of the most critical is maintaining durability and consistent performance under extreme operating conditions. Automotive connectors must withstand wide temperature ranges, high vibration levels, moisture, dirt, and chemical exposure—without failure.

Additionally, the increasing complexity of vehicle electronics means greater risk of electromagnetic interference (EMI), which can disrupt performance. As vehicles become more software-defined and sensor-reliant, ensuring clean, noise-free signal transmission becomes vital.

Supply chain instability worsened by geopolitical tensions, global chip shortages, and fluctuating raw material prices poses another major concern. Delays in connector production or delivery can lead to downstream bottlenecks for automakers and Tier 1 suppliers. Moreover, the need for sustainability and compliance with environmental regulations is putting pressure on manufacturers to redesign connectors with recyclable materials and eco-friendly manufacturing processes.

Real-World Example TE Connectivity’s EV Project

A standout example of innovation in this space is TE Connectivity, a global leader in connector and sensor technology. The company partnered with several electric vehicle (EV) manufacturers to develop high-voltage connector solutions specifically designed for compact EV platforms.

- Superior thermal management

- Robust EMI shielding

- Quick plug-and-play assembly features

- Resistance to shock, vibration, and temperature extremes

By integrating these custom connectors into EV powertrains, TE Connectivity helped manufacturers reduce wiring complexity, improve energy efficiency, and speed up vehicle production. This real-world application showcases how cutting-edge connector technology is enabling the next generation of electric mobility.

Applications in the Market

Automotive connectors are utilized across various applications to ensure secure and efficient electrical and data connections. In electric vehicles, they manage battery performance and power distribution. In ADAS-equipped cars, they support camera, radar, and sensor communication. Infotainment systems rely on high-speed connectors for audio, video, and GPS functions. Lighting systems, both exterior and interior, also depend on reliable connectors for uninterrupted performance.

Case Study TE Connectivity’s Role in EV Expansion

TE Connectivity, a global leader in connector technology, collaborated with multiple EV manufacturers to develop next-gen high-voltage connectors. These solutions were customized for compact EV platforms, offering thermal management, EMI shielding, and quick assembly. The result was improved vehicle performance and reduced time-to-market. This case highlights how connector innovation can enable faster EV development while ensuring safety and compliance.

Read More:https://www.heathcareinsights.com/automotive-radar-market/

Top Manufactures in Automotive Connectors Market

- TE Connectivity

- Aptiv PLC

- Amphenol Corporation

- Yazaki Corporation

- Molex Incorporated

- Sumitomo Electric Industries, Ltd.

- Hirose Electric Co., Ltd.

- JST Manufacturing Co., Ltd.

- Kyocera Corporation

- Rosenberger Group

Want custom data? Click here:https://www.visionresearchreports.com/report/customization/41602

Automotive Connectors Market Segmentation

By Product

- PCB

- IC

- RF

- Fiber Optic

- Other

By Connectivity

- Wire to Wire

- Wire to Board

- Other

By Vehicle

- SMEs

- Large Enterprises

By Application

- CCE

- Powertrain

- Safety & Security

- Body Wiring & Power Distribution

- Navigation & Instrumentation

How Different Regions Are Adopting Connectors

- North America

North America remains a leading region in the automotive connectors market, driven by rapid technological adoption and strong consumer interest in vehicle safety and connectivity. The U.S. and Canada have embraced Advanced Driver-Assistance Systems (ADAS), infotainment, and onboard telematics, all of which require complex connector solutions.

Government regulations like the Federal Motor Vehicle Safety Standards (FMVSS) and strong insurance-backed safety norms encourage automakers to integrate more electronic systems, fueling demand for durable, high-performance connectors. Moreover, the region’s strong research and development ecosystem, especially in California’s Silicon Valley and Detroit’s auto-tech hub, supports ongoing innovations in connector miniaturization, wireless connectivity, and signal shielding for autonomous and electric vehicles.

- Europe

Europe is at the forefront of sustainable and smart mobility, creating a robust market for advanced automotive connectors. Countries like Germany, France, Sweden, and the Netherlands are leading the shift to electric vehicles (EVs) through policy-driven incentives, carbon-neutral targets, and infrastructure development.

Strict safety regulations by bodies such as Euro NCAP and UNECE encourage OEMs to adopt advanced safety and data communication systems in vehicles, all of which depend heavily on connector networks. European automakers are also early adopters of modular vehicle platforms, increasing demand for flexible, high-density, and multi-function connectors. Additionally, the region is seeing growth in smart mobility projects, such as V2X trials and urban EV fleets, that require advanced connectivity infrastructure.

- Asia-Pacific

The Asia-Pacific (APAC) region is witnessing the fastest growth in the automotive connectors market, with countries like China, Japan, South Korea, and India playing pivotal roles.

China is the global leader in EV production and adoption. Its strong domestic EV brands and supportive government policies (such as subsidies and EV mandates) drive massive connector demand—especially for high-voltage, battery, and thermal management systems.

Japan is a key innovator in vehicle electronics, known for compact, energy-efficient designs. Connectors used in hybrid drivetrains, ADAS, and in-vehicle networking are a mainstay of Japanese vehicles.

South Korea, home to leading automotive and electronics manufacturers, emphasizes miniaturization and high-speed data connectors for next-gen infotainment and autonomous driving systems.

India is emerging as a growing market for connectors due to its expanding EV policies (like the FAME initiative), localization of auto component production, and rising adoption of connected two- and three-wheelers.

The APAC region also benefits from a strong supply chain for raw materials, connector components, and electronics manufacturing, enhancing scalability and innovation.

- Latin America

Though still at a developing stage, Latin America is gradually embracing automotive electronics, creating emerging demand for connectors in select markets.

Brazil leads the regional market, with growing investments in local vehicle assembly, increasing hybrid vehicle models, and gradual upgrades to in-vehicle electronics.

The rollout of emissions regulations and enhanced safety standards in countries like Mexico, Argentina, and Chile is prompting OEMs to integrate more electronics, particularly in urban passenger vehicles and commercial fleets.

However, limited infrastructure and higher vehicle costs remain challenges to wider adoption of EVs and ADAS systems, which impacts connector demand growth.

- Middle East & Africa (MEA)

The Middle East and Africa represent a nascent but growing frontier for automotive connectors.

In the UAE and Saudi Arabia, high disposable incomes and government-led smart city initiatives are encouraging the import and use of premium, tech-loaded vehicles with ADAS, infotainment, and EV capabilities.

Countries like South Africa are developing local automotive production zones, with growing interest in electric mobility and emission-free transport models.

Future Outlook

The automotive connectors market is poised for sustained growth as the global auto industry continues its pivot toward smart, electrified, and autonomous vehicles. The demand for high-speed data transmission, miniaturized designs, and modular architectures will continue to shape the market. Integration with emerging technologies such as V2X communication, wireless charging, and onboard diagnostics will create fresh avenues for connector innovation.

Buy this Premium Research Report@https://www.visionresearchreports.com/report/checkout/41602

You can place an order or ask any questions, please feel free to contact

sales@visionresearchreports.com| +1 650-460-3308